What is FinFloh Credit Decisioning AI?

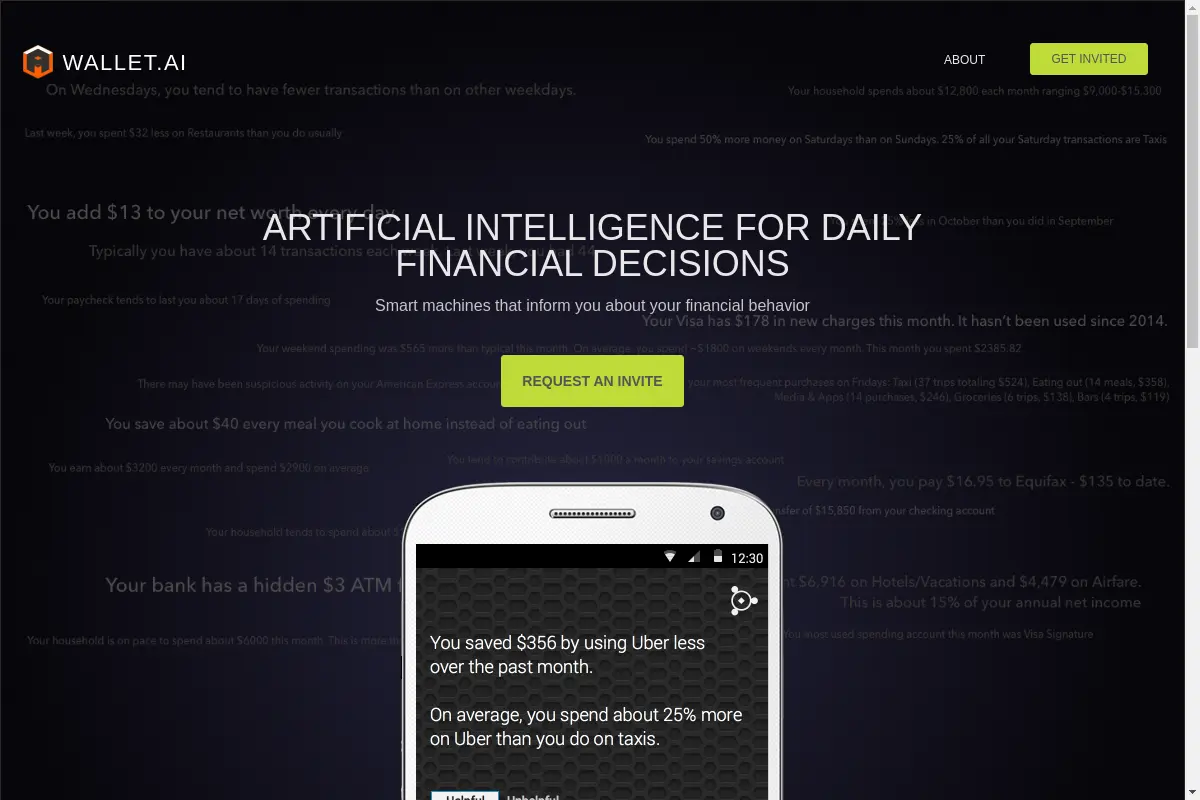

The product integrates AI and machine learning to provide dynamic credit scoring, credit recommendations, and synchronization with CRMs for real-time credit risk management and decision-making.

FinFloh Credit Decisioning AI's Use Case?

Use cases include smarter onboarding decisions, real-time credit risk monitoring, AI-driven credit recommendations, and CRM integration for updated account data.

Applicable people for FinFloh Credit Decisioning AI?

Financial institutions, credit managers, sales teams, and businesses looking to enhance credit risk assessment and management.

Is FinFloh Credit Decisioning AI free?

A 7-day free trial is available, but the full version is not free.